Putting People First

Putting You First

We start by putting your needs first. You can always contact us and we will promptly resolve your issue. We are structured as an inverted pyramid, we put all our clients needs on top. We volunteer in our community to give back, and provide annual policy reviews to our clients to stay connected with you. The job of your agent is to know and understand your unique situation and needs. We provide a comprehensive needs based analysis of your risks and exposures, identify your unique situation, risk tolerance, and then finally provide a proposal to offset undesirable risk to one of our trusted insurance providers. We would love your feedback. Let us know how we are doing.

VIP Service

You are not a policy number. When you call us, we will identify your account by your name. You are the reason we are here. We are here to help protect you. We provide valuable insight into risk management strategies and the ever changing insurance product landscape. We strive to become your trusted insurance adviser. Let’s talk about your hopes, your dreams, and your future, and then let’s make a plan together to get you there.

24/7 Online Service

We live in a connected world. This is the 21st century. You want 24/7 claims and customer service. But you don’t have to choose between either local personal service, or a large call center. Now, you can have it all. We offer 24/7 online policy access and online carrier direct personal claims filing. For those times you don’t want to talk to somebody, you can login and view your policy, request coverage changes, download ID cards and get quotes online with our online client center.

Local Professional Agents

When you do want to talk to someone, we are here for you. You have a personal and professional dedicated account manager that gets to know you and your situation. We can easily advise you on changes in the insurance market place. We have both, personal local agents and online policy access to best meet your busy lifestyle. As your insurance agent we are here to help you asses your risk, minimize your exposure, and manage your insurance spending, both on premiums and retained risk. Meet one of our agents today!

Partner Testimonials

That is enough of tooting our own horn. Learn more about our trusted business partners have to say about us, and read some clients testimonials. Then, when you are ready, we look forward to working with you too.

Next Steps

Now that you know a little bit about us, it’s time to take the next step and tell us a little bit about you. Start your online needs based analysis today.

What to look for in an Insurance Agent

When picking an insurance agent it is important to know who your agent represents. Some insurance agents are what are called “captive” agents. Captive agents work for the company they represent. Some examples of companies captive insurance agents work for are Allstate, State Farm, or Farmers. Captive agents are limited to only offering products to you that are offered by the company they work for, whether or not that product is the best solution for your unique situation.

An independent insurance agent works for you, not the insurance company. Independent agents are free to find a policy that best fits your needs no matter which insurance company is offering the coverage. Independent agents really do work for you, not the insurance company. They are free to offer multiple policy options side by side for you to review. When the insurance companies compete for your business, you win.

The agents at Alta Vista Insurance Agency are proud to be your local independent insurance agents. We are located in Vista California and strive to be a local independent resource for you, our clients. Our staff is your team, and we are here, ready, and able to provide responsive customer support to our neighbors throughout San Diego County. We primarily serve Vista, Oceanside, San Marcos, Escondido, Rancho Bernardo, and Poway. Please feel free to contact us for your insurance needs.

Contact us today to learn more about how we can service your California insurance needs. We look forward to hearing from you!

The One Way To A Speedy Real Estate Transaction

Would you marry someone whose history was a mystery? Or are you prone to purchase a car without knowing the facts of its past?

To connect you with the history of a home you’re considering, we’re offering a free report, guaranteed to give you peace of mind and help you avoid time and money-wasting complications during and after the sale.

Get a clue! Come on, seriously.

A C.L.U.E., the Comprehensive Loss Underwriting Exchange, is a loss history information exchange provided by LexisNexis® Risk Solutions Inc. It enables insurance companies to access and use prior loss information in the underwriting process. Think of it as “the cloud of claims”.

Here’s how it works

Each month, participating insurers submit loss information to the C.L.U.E. information exchange, which is loaded to the C.L.U.E. database. Insurance companies request this data by forwarding search criteria such as an insurance applicant’s name, risk address, date of birth, and Social Security Number. The C.L.U.E. system searches its database for information that matches the requested search criteria. A C.L.U.E. report is then generated and forwarded to the insurer. When you or your insurance company receive a C.L.U.E. report, it includes all losses accessed by the search criteria that were reported to us within seven years of the date of the request. Home warranty claims are not included on a C.L.U.E. report.

The C.L.U.E. report is a valuable piece of information to provide you a clearer look into the prior loss history of the property you’re peeking at.

Reading the report

First, you want to look for claims associated with the risk address. The report can sometimes show claims filed on another location owned or occupied by the seller. You’ll want to look for claims frequency rather than severity. These would be claims that indicate a potential ongoing problem or the possibility for future losses. Multiple occurrences to the same areas in the home can indicate faulty or defective systems. For example, water losses and mold are big ones to look for and are one of the most widely reported causes of loss or perils. Other perils to watch out for are fires occurring in the home, not wildfire, and theft or burglary. These type of losses could indicate morale hazards or the home could be in a questionable area. Insurance companies are tightening their guidelines when it comes to water losses resulting from inside water damage, not weather related flood claims. Effective this year, many admitted insurance carriers will decline a risk if there has been a significant water loss on the property within the last 3-5 years. This would include damage exceeding $2,500. Normally, losses follow the insured and can impact the cost of insurance or insurability when moving to a new location. Due to the rise in frequency and extensive costs resulting from water damage claims. more and more companies are looking at water losses at new business and declining.

One Final Thought

The cost of the damage is important and can indicate the severity of the incident and the amount paid by the insurance company for the loss. Accidents happen. Just because a property has been impacted by a large claim or series of claims does not mean you should avoid buying that house. Review the report with your realtor and request a disclosure from the sellers about how the claims were resolved. Were all repairs completed and was everything built back to code? Was the home replaced with like kind and quality?

Talk to your insurance agent about the loss(es) that were filed, how the insurance companies handled the claims and how this will impact insurance for the home moving forward.

6 Ways to Protect Your Income Property

A workflow is necessary to upkeep your income property. We’ve developed a checklist so you know you have all your “i’s” dotted and “t’s” crossed.

Access This Resource Here

Get a Free Evaluation for Your Income Property

Sustainable Self-Improvement in the New Year

Gear Up for the New Y–No, for Today

Recently, I saw a piece of decor that said “I hope your troubles and worries last as long as your new years resolutions.” I laughed.

The trite and unsustainable nature of New Years resolutions make them difficult to take seriously and for me to write about. I know the likelihood of any of us keeping up with our emotions-driven and wind-swept vision of our healthiest, happiest self is slim at best and a blog post like this one has the opportunity to be as yawn-worthy as the rest.

All sorts of concerns may come to your mind when it comes to new years resolutions–(most of my concerns are covered here, in a blog post from Medium).

Concerns might include: the problem of shame associated with missing the mark, unwisely viewing the start the year as the only opportunity to start a goal, setting goals you feel like you should accomplish rather than what you want to accomplish.

Assuming you’re looking for sustainable and healthy growth and possess a personal motivation and hopeful attitude about failure, please enjoy the following.

We’ve compiled a group of quick starts on your biggest goals, because you’re awesome and have lots of both realized and unrealized potential, as well as areas of improvement and discovery awaiting you right now.

Hopefully, I do not seem overly enthusiastic but I truly hope you see the gold in you because it’s there.

We hope these ideas can encourage you to live an overall better life. May your resolve be to improve the quality of your life so you can share your days with others and help them.

So, without further ado, our compilation of resources to help you with some of the goals people often pursue:

This New Year I’d like to…

… exercise more. (Run or walk a 5k in San Diego or another city. Sign up today to hold yourself to it! Also, if you’re over 50 and wanting to get fit, here’s an article that will help you get fit!)

… try something new (COME SWING DANCING or go on Meetup and search for something you’ve always wanted to do, like Taiko drumming, motocross, knitting, or a Spanish meetup.)

… spend time with friends and family (Take the kids out for ice cream and other adventures on the cheap, start a dinner club, put the kids’ games, dance shows, etc on the calendar and get there).

… quit smoking (Gamify quitting with this app).

… learn how to rest and care for myself.

… read more (Book club it up. Access free audio books and ebooks on your phone, computer, or tablet through your library. Sub our newsletter, we are always putting interesting articles together!)

Think, the starting line is always today, not January 1st (unless today is January 1st then this is a moot point).

Whatever your goal is, go get ’em, tiger.

Helping you reach new heights,

Alta Vista Insurance

Homeowners Insurance Checklist

What you need to know about protecting your lifestyle

The insurance market is in a “shift”. Rate activity has been increasing, claims frequency and severity has risen, and more than half of homeowners are underinsured by an average of 20 percent according to Christopher P. Hackett, senior director of Personal Lines for Property Casualty Insurers Association of America (PCIAA).

How should homeowners approach their insurance so they make sure they have the right protection for their assets?

We’ve put together a great checklist for homeowners to help you make a plan and take the right path with your insurance.

This is a great resource to use on our Personal TRAIL!

Checkpoint 1: Updates to your home

Whether you recently purchased your home or owned it for many years, it’s important that you review any home improvements with your insurance agent. Things like adding square footage, new flooring, remodeled kitchens and bathrooms, auxiliary dwelling units (AUD), solar panels, etc.

Agent Tip: Ask your agent to recalculate your homes replacement value or insurance to value with the up-to-date information. Be sure to discuss any exposures associated with remodeling or additions with your agent so you have the right protection.

Checkpoint 2: Consider value and cost

A low premium is good, but your home insurance may be less because it doesn’t provide the right protection for your lifestyle. Peace of mind knowing all your assets are fully protected is more valuable than you think. Review your policy and understand the value your insurance company provides; financial stability, exceptional claims handling, and ease of doing business are some of the benefits to consider.

Checkpoint 3: My valuable items?

Look around your house. What are the items that are most valuable to you? Your homeowners insurance generally covers the contents of your home. However, there are limits on certain target items such as jewelry, artwork, collections, antiques and silverware. In order to protect these items up to their full value, you may want to add scheduled personal property coverage. If the items are damaged or stolen, you can have peace of mind knowing you are fully covered.

Checkpoint 4: Add extended dwelling replacement cost coverage

Review your dwelling coverage. Some home policies have limitations on the coverage for the structure. Make sure your coverage matches the reconstruction cost of your home and add extended dwelling replacement cost coverage. This will provide you with the additional coverage you need in case the replacement cost of your home rises over time due to increased construction costs, labor costs, or supply and demand.

Checkpoint 5: Review the need for earthquake and flood insurance

Homeowners insurance does not cover damage from outside flood waters or earthquakes. You need a separate flood insurance policy and earthquake insurance policy. Talk to your insurance agent about these common perils and how to avoid being uninsured.

Watch our short video to learn more about home insurance

Replacement Cost vs. Market Value

Home Insurance: Do you have enough coverage?

As the market shifts its’ important to understand how to fully protect your home and your lifestyle. After the recent Woolsey and Camp fires, which destroyed nearly 8,000 homes, homeowners need to be aware of how much coverage is required to replace your home if it is destroyed by a covered peril.

Insurance 101 Tip: A peril is a specific risk or cause of a covered loss.

Common covered perils are fire, wind or hail, and water damage. One of the best ways to determine insurance coverage for a home is understanding replacement cost vs. market value.

This infographic from, The Hartford, is a great way to understand the difference between the “cost to rebuild” and the “cost of the air”. Replacement cost is based on how much coverage is require to rebuild a home to its original state before the loss. Market value is based on confidence or how much someone is willing to pay for a home.

Remember, replacement cost can be very different from the market value of a home and after a large natural disaster, like a wildfire, replacement costs can rise significantly due to supply and demand, cost of labor or materials, and transportation costs associated with rebuilding.

Have you reviewed your property insurance lately? Don’t wait until a disaster happens to find out your coverage is inadequate.

Take the right path with your insurance! Start our personal TRAIL today!

Learn more about the important things you need to know about home insurance.

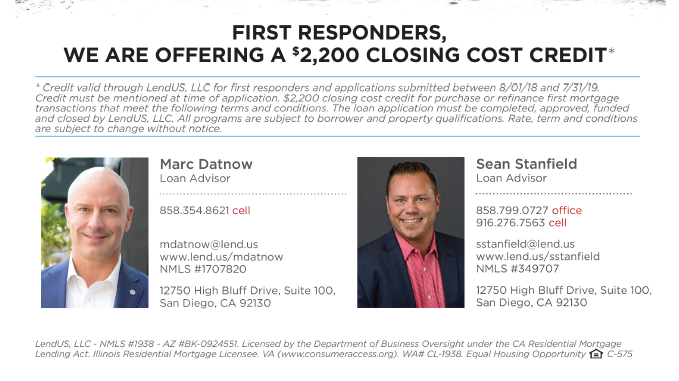

LendUs Offering $2,200 Closing Cost Credit For First Responders

Seth’s friends at LendUs are giving back to our first-responders.

First-responders who buy their property through LendUs will receive a $2,200 closing cost credit.

If you are not a first-responder, please consider sharing this valuable information with someone who is!

Check it out!

The Restorative Practice of Gratitude

As a kid and —let’s be honest—often even now, I tend to send out thank you cards later than propriety demands.

Frequently I’ll even write them and never get around to sending them.

…yeesh.

While this is not a good way to maintain friendships, it turns out even just doing that has a salutary effect on one’s mental health.

In “How Gratitude Changes You and Your Brain,” written by two Ph.Ds from Berkeley’s Greater Good Magazine, they quote a study done on 300 adults receiving mental health counseling at the university. Compared to those who didn’t write at all as part of their health regimen, or those who focused their writing on sorrowful topics, people “who wrote gratitude letters reported significantly better mental health four weeks and 12 weeks after their writing exercise ended.”

Here’s the kicker (and encouraging part for me): even though only 23% of those who wrote thank you letters sent them, both the group of “senders” and “non-senders” still experienced greater positive emotions and longer-term, faster-acting effects on their mental health.

While I don’t advise writing a heartfelt thank-you note and not sending it, it’s noteworthy to recognize that the simple practice of being grateful and expressing it may actually improve health.

Sounds good, right?

Many of us have our parents to thank for teaching us about thank you notes. Unfortunately, because of that, they have the potential–for example, for me–to initially feel like a chore rather than a joy.

However, my response to this internal argument is two fold: they bless another person AND they affect your health positively. Booyah, I’m into it.

Thank you notes are not the only way to get the benefits of practicing gratitude, though. Whether written, verbal, or simply internal, practicing gratitude will likely affect you positively, during a season, which many will admit, is supposed to be all warm and fuzzy but really yields much anxiety and heartache for many.

Care for yourself this season by instituting small moments of gratitude through encouragement of others, in prayer, affirmations, and/or living mindful of things in life you enjoy and appreciate.

…

A new holiday is coming up, too, Giving Tuesday.

Check out the stories and get involved here!

Sources: